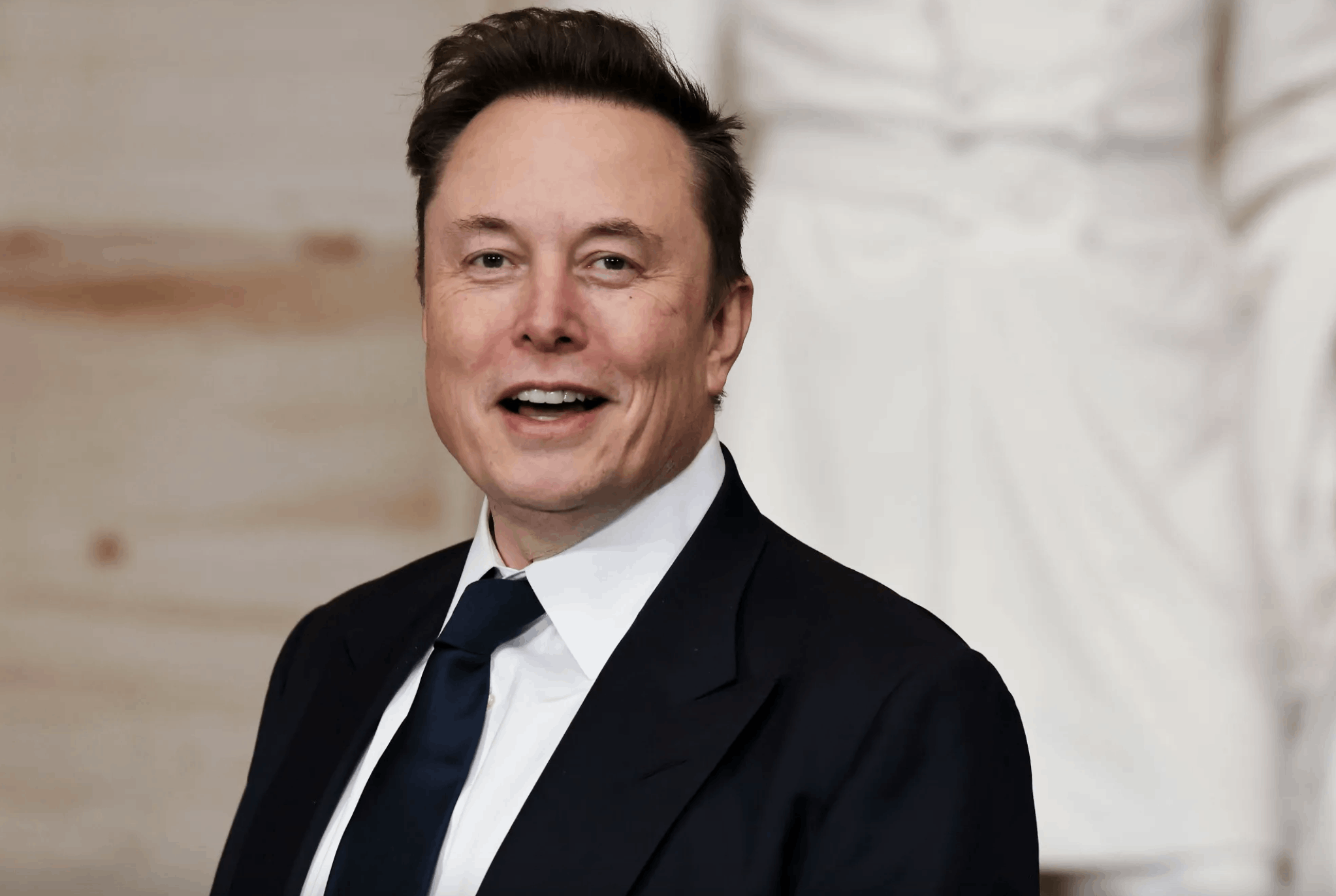

Elon Musk Reclaims World’s Richest Title After Brief Loss to Larry Ellison

In a dramatic reversal that has captured global headlines, Elon Musk has once again claimed the top spot as the world’s richest person, overtaking Larry Ellison in what observers are calling one of the most volatile billionaire rankings in recent memory. According to the latest estimates, Musk now holds an approximate net worth of $477 billion, leaving Ellison at approximately $367 billion.

The succession was swift. On September 10, 2025, Ellison had momentarily surged ahead of Musk—reportedly gaining $100 billion in one hour—to become the richest person on Earth. Yet that reign was short-lived: within hours, Musk responded with gains that pushed him past Ellison and reclaimed his long-held position. The events mark yet another turn in the high-stakes financial duel between two of the most visible titans of tech and business.

For Musk, this comeback is more than just a numbers game. His wealth is closely tied to multiple high-growth ventures: Tesla, SpaceX, Neuralink, and others. As share price fluctuations affect Tesla, regulatory developments, market sentiment, and the outlook for Musk’s aerospace ambitions all play a role. In contrast, Ellison’s wealth is heavily linked to his control over Oracle and to various investments in real estate and other tech ventures. The contrast in their wealth sources underscores how different business models weather volatility.

Ellison’s brief takeover of the top spot highlights the razor-thin margins at the top echelon of billionaire rankings. In modern wealth tracking, net worth is subject to sudden swings, depending on public market values, private holdings, shifts in investor sentiment, and even macroeconomic trends. A single news item—such as a regulatory decision, acquisition, or earnings report—can move billions of dollars in a matter of minutes.

For Musk, pushing past the $400 billion threshold once again affirms not just his resilience but the market’s continued belief in his portfolio of ventures. Tesla, for example, remains a bellwether for clean energy adoption, electric vehicle demand, and supply chain logistics on a global scale. His space exploration ambitions through SpaceX—ranging from satellite launches to ambitious plans for Mars—continue to capture both public imagination and investor confidence.

Meanwhile, Ellison’s strength remains formidable. As co-founder and executive chair of Oracle, and with extensive real estate holdings, his business empire is diversified and deeply rooted. Oracle continues to capitalize on trends in enterprise software, cloud computing, and data infrastructure, all of which remain essential sectors in the digital age.

The competition between Musk and Ellison also reflects broader themes in global wealth dynamics. In recent years, the richest people in the world have seen their fortunes shaped by innovation, technology, and regulatory environments. Emphasis on climate tech, renewable energy, and artificial intelligence has tended to favor visionaries willing to take huge risks in markets that are still emerging, while more established sectors perform steadily but generally with less explosive growth.

Public reaction has ranged from admiration to criticism. Some praise Musk’s continued dominance as proof that visionary risk-taking pays off. Others argue that the extreme concentration of wealth raises questions about economic inequality, taxation, and the responsibilities of billionaires. Many analysts urge careful observation of how these wealth shifts translate into influence—not only in business, but in policymaking and global investment.

Financial commentators also cite another lesson: wealth—even at the very top—is rarely static. The disparity of $110 billion between Musk’s current estimate and Ellison’s reflects one of the larger gaps in recent billionaire rankings, but even that gap could narrow quickly depending on market moves. Investors, watchers of corporate earnings, and media outlets now seem to wait for the next quarterly report, product launch, or regulatory change that might tip the balance again.

For Musk, the win is symbolic but also strategic. Being the world’s richest person carries media attention and scrutiny. It can affect negotiating power, influence in consumer markets, and the ability to shape narratives around technology, space exploration, and sustainable energy. For Ellison, the moment of topping the list—even briefly—demonstrated his continued relevance and the strength of Oracle and his investments in an increasingly tech-driven world.

Looking ahead, the question many are asking is: Can Musk maintain this lead through 2026 and beyond? With competition from other billionaires—those in tech, in AI, in biotech, in finance—no lead is guaranteed. Meanwhile, macroeconomic trends, regulatory pressures (particularly in the U.S. and Europe), supply chain concerns, and geopolitical risks all loom as potential disruptors.

But for now, Elon Musk stands once again at the summit, not merely because of tickers and valuations, but because his business bets continue to resonate with what markets are rewarding: innovation, scale, audacity. Whether in electric vehicles, rockets, artificial neural interfaces, or beyond, Musk’s portfolio seems built for an era where the future is rapidly being redefined.

In the swirling hand-of-fortune world of billionaire rankings, today’s headlines belong to Elon Musk, but tomorrow’s fortunes remain anyone’s guess.