In an era defined by rapid technological transformation, two headline-grabbing stories are capturing both investor and public attention: Wedbush analyst Dan Ives’s insights into Sam Altman’s identity startup World (formerly Worldcoin), and the unprecedented compensation proposal Tesla has put forth for CEO Elon Musk. Both narratives underscore high-stakes bets on the future—one on the nature of identity in an AI-saturated world, the other on the face of corporate compensation and governance.

World: Redefining Identity in an AI-Dominated Future

Sam Altman—best known as the CEO of OpenAI—has reentered the spotlight with a renewed push in identity verification, now operating under the name World, previously known as Worldcoin. The project has pivoted from its earlier cryptocurrency roots to focus onbiometric identity technology, using iris-scanning devices called “Orbs” to establish proof of humanness in a digital world increasingly threatened by AI impersonation.

As of May 2025, World has launched in the U.S., deploying Orbs in cities including Los Angeles, Miami, San Francisco, Nashville, Austin, and Atlanta, in standalone retail locations and through partnerships like Razer. The initiative complements a planned deployment of 7,500 Orbs nationwide by year-end, with the portable “Orb mini” slated to debut in 2026

Beyond physical hardware, World is broadening its ecosystem. Upcoming offerings include a Visa-backed debit card, stablecoin support, integration with Stripe, and U.S. partnerships like a verification pilot with Tinder in Japan—all aimed at strengthening the linkage between identity and financial utility

However, this ambitious rollout is not without its critics. Civic groups and regulators in jurisdictions such as Brazil, Hong Kong, Kenya, and New York are sounding alarms over privacy, biometric data storage, and the ethics of incentivizing biometrics for economic inclusion .

Amid this backdrop, Dan Ives—formerly with Wedbush Securities and now chair at Eightco Holdings—has taken a front-row seat in the evolution of World’s impact on finance and identity. Eightco is pivoting to accumulate Worldcoin as its primary reserve asset, raising $250 million via private placement and $20 million from BitMine investors. The company plans to rebrand its Nasdaq ticker from “OCTO” to “ORBS” after closing its financing on September 11, 2025—mirroring MicroStrategy’s Bitcoin treasury strategy

For Ives, this move signals a growing institutional confidence in World’s aspirations—not just as a tech novelty, but as a foundational layer of digital identity with real-world adoption. His involvement bridges the startup’s consumer identity ambitions with Wall Street’s capital markets.

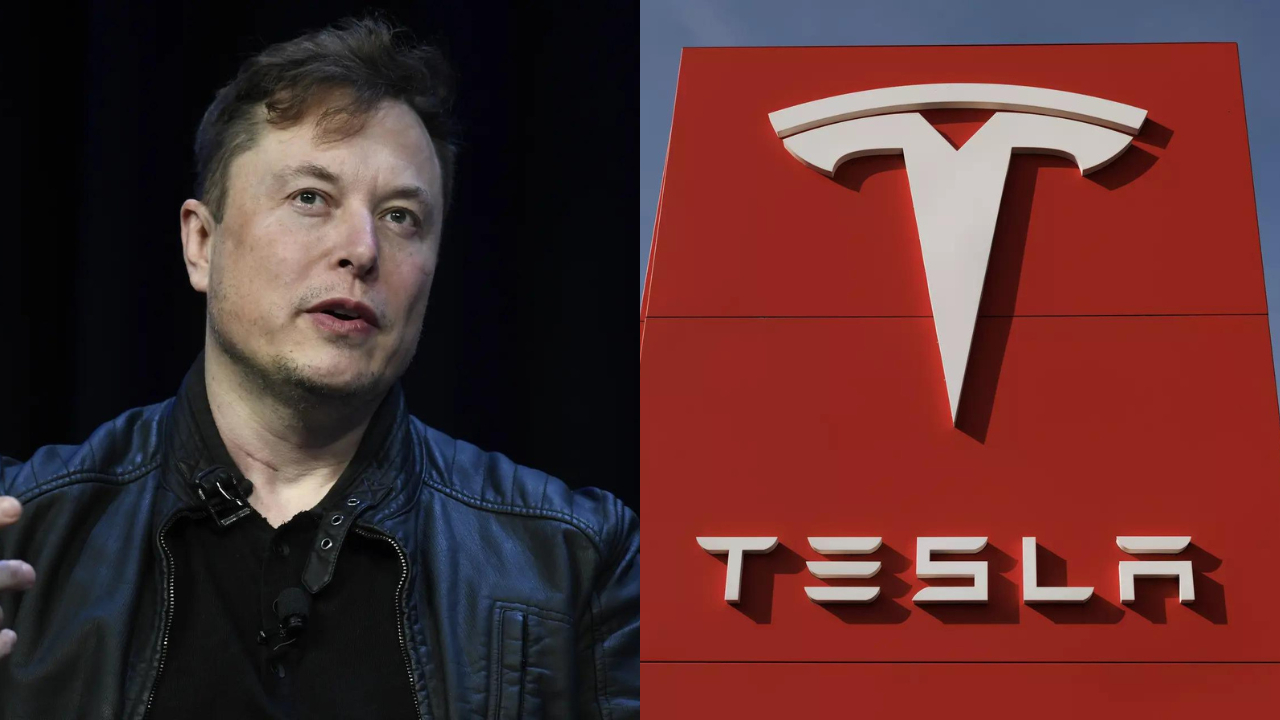

Tesla’s Game-Changing CEO Plan: Musk’s Trillion-Dollar Vision

In a starkly different but equally ambitious scenario,Tesla has proposed what could be the largest executive compensation package in corporate history—for Elon Musk. The plan would potentially make Musk the world’s first trillionaire, depending on his ability to steer Tesla through an audacious future.

Under the proposed terms, Musk could receive up to 12% of Tesla’s shares, contingent on the company achieving an $8.5–8.6 trillion market capitalization—a dramatic leap from its current evaluation of around $1 trillio

Rolling out 1 million robotaxis

Scaling humanoid robot production

Boosting annual vehicle production to 20 million

Expanding Full Self-Driving subscriber base to 10 million

Reaching approximately $400 billion in adjusted EBITDA—up from $16.65 billion in 2024

The package is structured in 12 vesting tranches over ten years, with Musk’s continued leadership and long-term commitment (minimum 7.5 years) required . Tesla’s board has framed the offer as purely performance-based, offering no salary or cash bonus, directly tying Musk’s fortune to Tesla’s success. The plan will require shareholder approval during Tesla’s annual meeting in November 2025 .

Supporters see this as aligning Musk’s interests with long-term shareholder value, while critics warn it may exacerbate corporate governance flaws and shareholder dilution. Notably, the target valuation would make Tesla the most valuable company ever seen

Dan Ives’ Dual Role: Observer to Instigator

Dan Ives offers a compelling through-line between these two stories—positions that illustrate the evolving intersection of identity, AI, and executive compensation.

As chairman of Eightco Holdings, Ives is orchestrating an identity-to-asset movement by embracing World (formerly Worldcoin) not as a speculative cryptocurrency but as a long-term treasury holding for the company. This bet emphasizes his belief in the technology’s staying power, particularly as a shield against AI impersonation and identity fraud

As an analyst and policymaker on Tesla, Ives has long advocated for strategic structures to secure Musk’s leadership. In 2025, he welcomed Tesla’s interim restricted stock grant—earlier than the current proposal—as essential for stabilizing the company’s leadership outlook through 2030 and clearing compensation overhangs

Most recently, Tesla’s new package aligns with Ives’s perspective: a long-term retention mechanism rooted in ambitious performance targets. Though he hasn’t publicly commented on the latest proposal in available sources, it unmistakably builds on his long-held thesis that Musk must be anchored to Tesla through structural incentives.

Conclusion: High-Stakes Bets on Our Digital Future

The convergence of these stories paints a larger picture:

World represents humanity’s attempt to retain control over identity in a world where AI blurs the line between person and program. Its ascent into US and global markets, backed by significant capital and infrastructure, underscores both promise and controversy.

Tesla’s compensation proposal reflects the immense faith placed in Musk—and AI-driven robotics and mobility—as the centerpiece of a multi-trillion-dollar economic transition.

Dan Ives stands at the crossroads of both: guiding institutional adoption of identity technology while championing long-term governance frameworks for one of tech’s most polarizing leaders.

As identity becomes a battleground in the AI era and executive incentives redefine corporate ambition, these intersecting narratives provide vital insights into how our digital future—and its leaders—are being shaped today.